Chip stocks saw a significant jump in out-of-hours trading on Wednesday, led by Nvidia, which continued its market rally from the previous day. Nvidia’s shares were up around 0.6% to over $136 during out-of-hours trading, following a record high close on Tuesday at $135.58, marking a more than 3.5% increase. This rally also boosted the stock prices of other chipmaking companies, especially in Asia, which is home to some of the largest tech manufacturers and Nvidia’s competitors. Taiwan Semiconductor Manufacturing Company (TSMC), Hua Hong Semiconductor, Semiconductor Manufacturing International Corp, Samsung Electronics, and SK Hynix all saw significant gains during trading hours.

Shares of U.S. chipmaking giants, however, remained largely flat during out-of-hours trading on Wednesday. Arm Holdings (ARM) and Micron Technology (MU) saw modest increases, while Intel remained relatively unmoved. Hon Hai Technology Group, also known as Foxconn, experienced a jump in its stock price following Nvidia’s rally. The Taiwanese company has partnered with Nvidia to build AI data centers using Nvidia’s chips for various applications, such as robotics platforms, electric vehicles, and large language models (LLMs).

Nvidia’s journey from being a gaming chipmaker to an AI giant has been remarkable. The company recently overtook Microsoft as the world’s most valuable public company, highlighting its strategic pivot towards specialized AI chips. The boom in generative artificial intelligence, fueled by OpenAI’s ChatGPT release, has significantly boosted Nvidia’s growth trajectory. The company’s market capitalization has soared from around $16 billion in 2016 to nearly $800 billion in 2021, before dropping to around $300 billion in 2022. However, Nvidia’s value has surged again, reaching $3 trillion by mid-2024, with its shares up more than 170% this year alone.

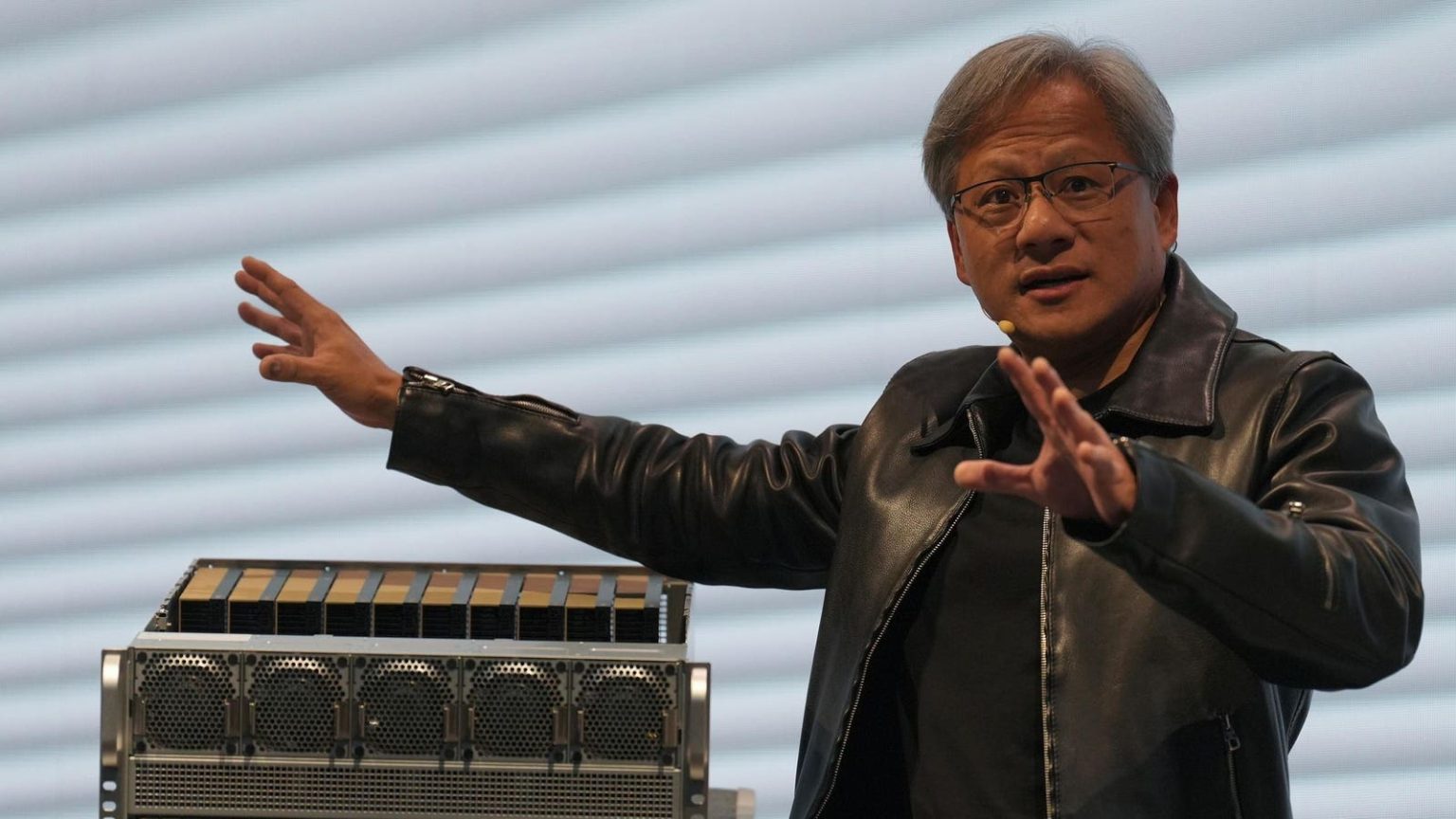

Nvidia’s CEO Jensen Huang has also benefited immensely from the company’s success, with his wealth estimated at $118.7 billion by Forbes. Following the recent bump in Nvidia stock, Huang’s net worth increased by $4 billion in a single day. He is now the 11th richest person in the world, surpassing Indian billionaire Mukesh Ambani. Huang is closing in on the top ten richest people in the world, trailing Microsoft billionaires Steve Ballmer and Bill Gates. The AI boom has not only positioned Nvidia as a key player in the tech industry but also elevated Huang’s wealth and status on the global billionaire ranking.

Forbes has launched text message alerts for breaking news, providing readers with real-time updates on the latest stories shaping the day’s headlines. Readers can subscribe to these alerts by texting “Alerts” to (201) 335-0739 or signing up through Forbes’ website. The AI boom and Nvidia’s unprecedented success in the market continue to attract attention and investment, as the company solidifies its position as a dominant force in the rapidly evolving tech landscape.