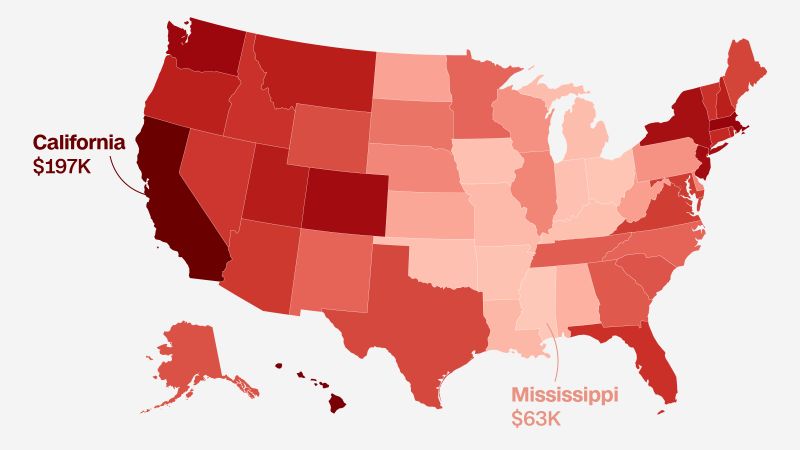

According to a new analysis from Bankrate.com, nearly half of US states now require a six-figure household income in order to afford a median-priced home if the buyer is planning to get a mortgage. This is a significant increase compared to January 2020 when only six states and the District of Columbia required a six-figure income. The high mortgage rates, high home prices, and decreased housing supply have made the process of buying a new home challenging for many individuals.

The analysis looked at the median price of homes in each state and calculated the household income needed to afford a mortgage payment that would not exceed 28% of gross household income. This calculation assumed a 20% down payment and a 30-year fixed-rate mortgage at the average 52-week rate. The study did not factor in closing costs or post-homeownership expenses. While the median price of a home in a state can provide a general idea of affordability, it may not accurately reflect the prices in specific areas within the state where buyers may be looking to purchase.

Buyers are faced with the reality that a higher household income is necessary in many states in order to afford a median-priced home. As housing prices continue to rise and mortgage rates remain high, the affordability of purchasing a home becomes increasingly difficult for individuals. The cost of securing a manageable mortgage payment is just one aspect of the overall expenses associated with buying a home, and buyers need to consider additional costs such as closing costs and ongoing homeowner expenses.

The challenging housing market conditions have forced many potential buyers to reconsider their options or delay purchasing a home altogether. High home prices, high mortgage rates, and a limited housing supply have created a competitive market where affordability is a major concern for buyers. The increase in required household income to afford a median-priced home in many states highlights the financial strain that buyers are facing in today’s housing market.

As buyers navigate the complexities of the current housing market, they must carefully consider their financial situation and options before making a decision to purchase a home. The affordability of housing varies significantly based on location, and buyers may need to adjust their expectations or consider alternative housing options in order to find a home that fits within their budget. With housing prices and mortgage rates continuing to rise, buyers must be prepared to carefully assess their financial readiness before diving into the home buying process.