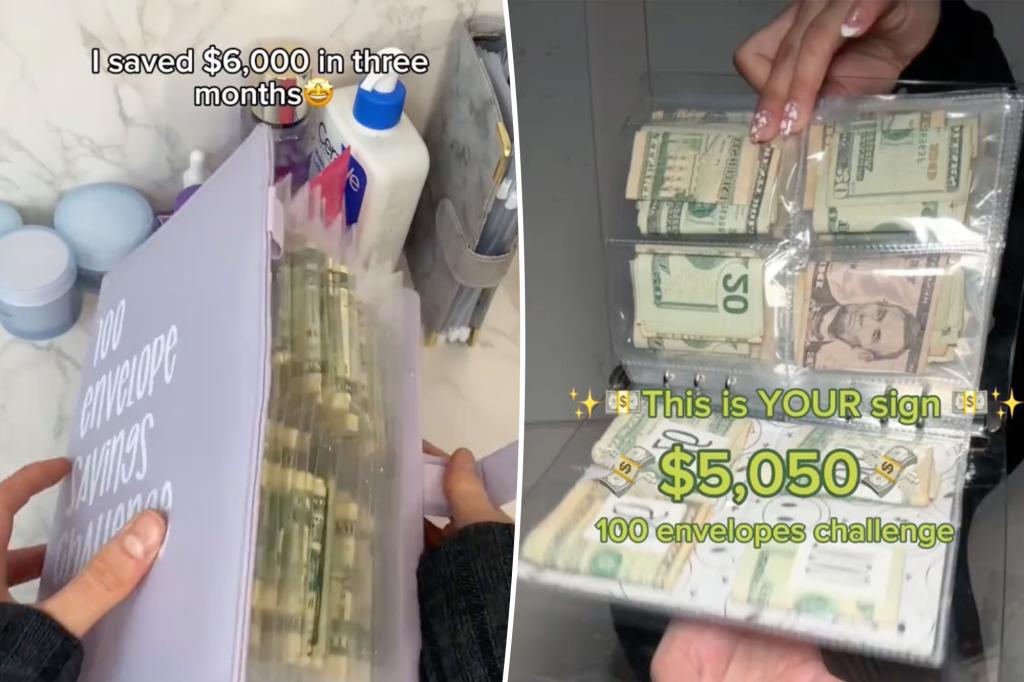

The “100 Envelope Challenge” has become a popular way for individuals to save money, with some participants managing to accumulate over $5,000. The challenge involves starting with 100 envelopes numbered 1 to 100 and depositing the corresponding dollar amount every day. This method adds a sense of gamification and fun to saving money, making it a motivator for participants. The challenge was originally popularized by a TikTok creator named Milly (@budgetwithmilly), who educates her followers on being economical.

Some participants choose to deposit money in chronological order, while others select envelopes randomly. Regardless of the method, the end result is the same – a significant amount of savings. The challenge helps individuals turn saving money into a game, providing a clear path and goal to follow, which can reduce the mental load of planning and staying focused. This approach is especially beneficial for those who are more visual and prefer to see the dollar bills they are saving rather than using credit cards for purchases.

However, it is important not to deposit so much cash that it disrupts your ability to pay bills or results in an account overdraft. It may not be realistic to deposit the full amounts required by the envelopes, especially as the numbers get higher. Customizing the dollar amount to fit your budget is recommended, as the main goal is to save more than if you didn’t participate in the challenge. While the challenge requires multiple visits to the ATM and finding a secure hiding place for the cash, some experts suggest digitalizing the challenge by transferring money from a checking to a savings account every day.

TikTok is filled with financial advice and money-saving trends, including the envelope challenge. However, it is essential to remember that social media often showcases the highlight reels of individuals’ lives, and it may not reflect the full financial reality. While some participants may find the challenge easy and complete it successfully, there are also many who struggle to keep up or face unexpected expenses that derail their progress. Overall, the challenge can be a fun and motivating way to save money, as long as it is done in a manner that fits with an individual’s budget and financial goals.