California Governor Gavin Newsom announced on Friday that the state is facing a budget deficit of $27.6 billion. To address this shortfall, he is proposing drastic measures such as eliminating 10,000 vacant state jobs and cutting spending across 260 state programs. The proposed $288 billion state budget for the upcoming fiscal year is the largest budget of any state in the country. One-time cuts include reductions in spending for broadband expansion, employment services, and water storage projects. Ongoing cuts will affect various programs, such as housing units in state prisons, pandemic-related funding for public health departments, and a scholarship program for college students pursuing a teaching credential.

Despite the significant deficit, Newsom’s proposed budget is smaller than the $38 billion shortfall predicted in January. The current deficit does not account for $17.3 billion in cuts and actions already agreed upon by Newsom and lawmakers to help close the gap. The ongoing economic challenges faced by California, including decreasing state revenues and a slowdown in the technology industry, have contributed to the budget crisis. Tax collections from major sources like personal income, corporations, and sales have fallen by over $6 billion compared to previous estimates, leading to the need for extensive budget cuts and adjustments.

Newsom, who is serving his last term as governor and has aspirations for a presidential run, is seeking to address not only this year’s deficit but also a projected $28.4 billion deficit for the following year. To achieve this, he plans to implement over $32 billion in cuts that the state Legislature must pass by June 15. Democratic legislators have expressed support for Newsom’s efforts to address multiple years of deficits while vowing to protect funding for social safety net programs and classrooms. However, Republicans have criticized Newsom for what they perceive as irresponsible spending management, arguing that budget gimmicks and borrowing will only exacerbate future problems.

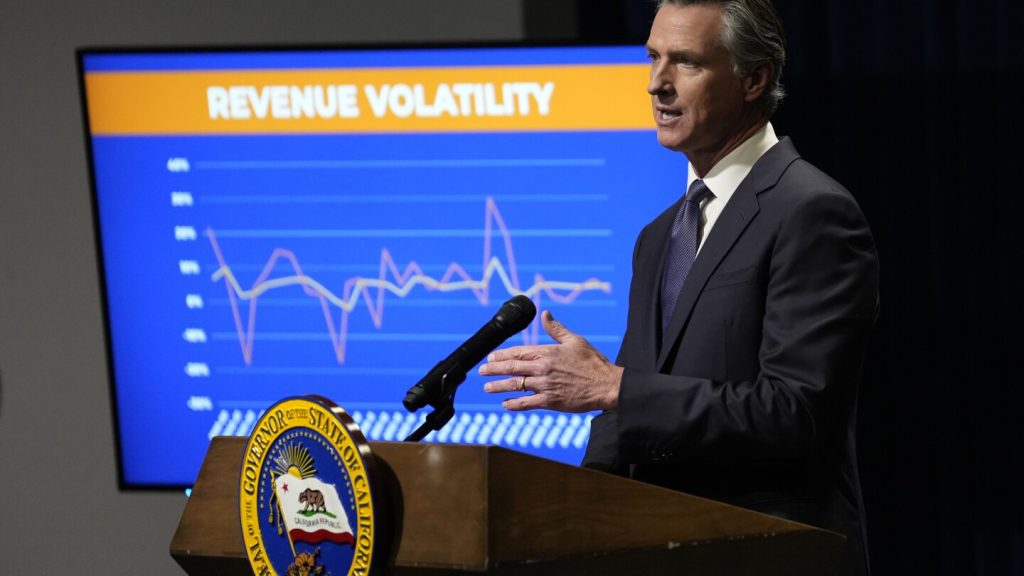

The state budgeting process in California, with its progressive tax system heavily reliant on wealthy individuals for revenue, makes the state susceptible to fluctuations in the stock market. If revenue projections are incorrect and the state falls short on funds, a budget deficit ensues as California’s Constitution mandates a balanced budget. Last year, unforeseen factors such as delays in tax filing due to severe weather disrupted revenue predictions. Newsom and lawmakers have already agreed on $17 billion in reductions and deferrals, in addition to plans to withdraw $13 billion from the state’s savings accounts to address the deficit. Corporate tax collections have experienced a significant drop, while income tax growth is attributed to stock market gains rather than overall economic improvement.

The ongoing budget crisis in California underscores the challenges facing the state’s economy, exacerbated by the COVID-19 pandemic and other economic factors. Newsom’s proposed budget cuts and adjustments aim to address immediate and projected deficits, with a focus on balancing the budget while preserving essential services and programs. As the state Legislature works to pass a spending plan by the deadline, the debate over fiscal responsibility and long-term financial planning continues among lawmakers and stakeholders. The upcoming release of the Legislative Analyst’s Office’s new estimate on the deficit will provide further insight into the state’s financial challenges and the necessary steps to achieve financial stability.