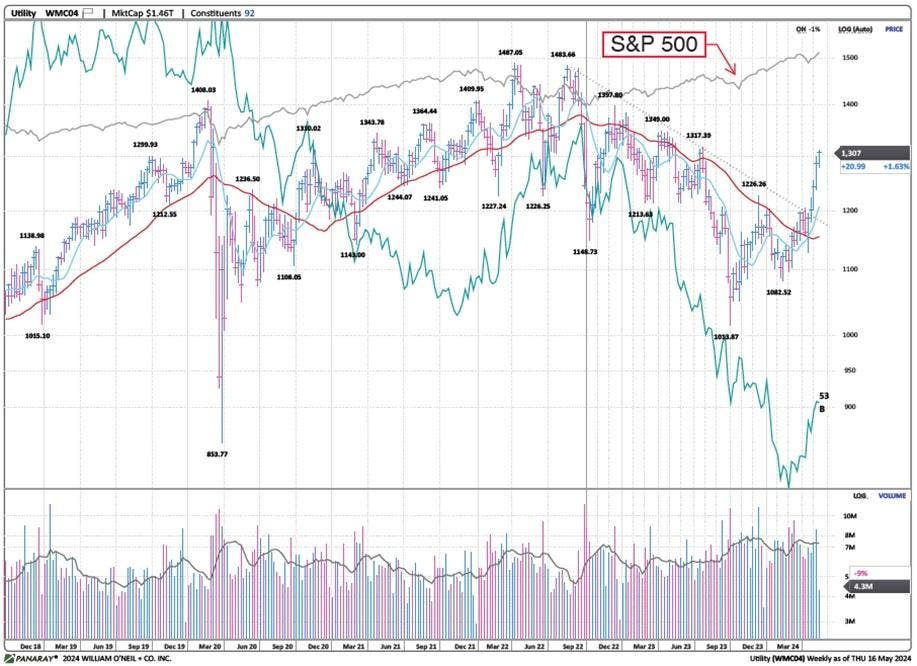

Investors may need to shift their perspective on the utility sector as various factors are aligning to potentially boost its performance. Over the past five years, the utility sector has significantly lagged behind the overall stock market, mainly due to higher interest rates and slower earnings growth relative to the market. However, recent data suggests that this trend may be reversing, with the sector showing signs of improvement.

The relative underperformance of the utility sector has narrowed over the past two months, and it is now positioned in the top left quadrant of sectors that are improving within the William O’Neil & Co. Sector Rotation Graph. Electric Power Utilities, in particular, are showing strength within the sector, with the potential to outperform the market in the coming months and close the performance gap of the past few years.

The outlook for the utility sector is optimistic as the US transitions towards electrification across various industries, such as transportation, renewable energy, and homebuilding. This shift is expected to drive an increase in electricity demand over the next decade, leading to new investment opportunities within the sector. Non-profit Regional Transmission Organizations (RTOs) are also expected to play a crucial role in overseeing price-competitive markets and ensuring supply meets demand.

Companies operating in price-competitive markets with the ability to take advantage of rising market rates for power are likely to benefit from the increasing electricity demand. Independent power producers with nuclear exposure are already reaping the rewards of new production tax credits signed into law with the Inflation Reduction Act. Stocks of companies like Constellation Energy, Vistra Energy, and NRG Energy have seen substantial gains year-to-date, positioning them as top performers within the S&P 500.

As demand for electricity continues to rise, sectors like data centers and oil and gas production are expected to be key drivers of electricity consumption. Companies in these sectors, especially those with nuclear and renewable energy exposure, are anticipated to perform well in the current market environment. Moreover, support industries such as construction and energy consultants are also likely to prosper alongside the growing demand in the electric utility industry.

In conclusion, the electric power industry is poised for growth as societal, government, and industry trends converge to drive an increase in electricity demand in the US. Investors are encouraged to consider adding exposure to the utility sector in their portfolios, with a focus on nuclear-related companies that stand to benefit from the current market dynamics. With the potential for significant growth in the sector, now may be an opportune time for investors to explore opportunities within the utility industry.