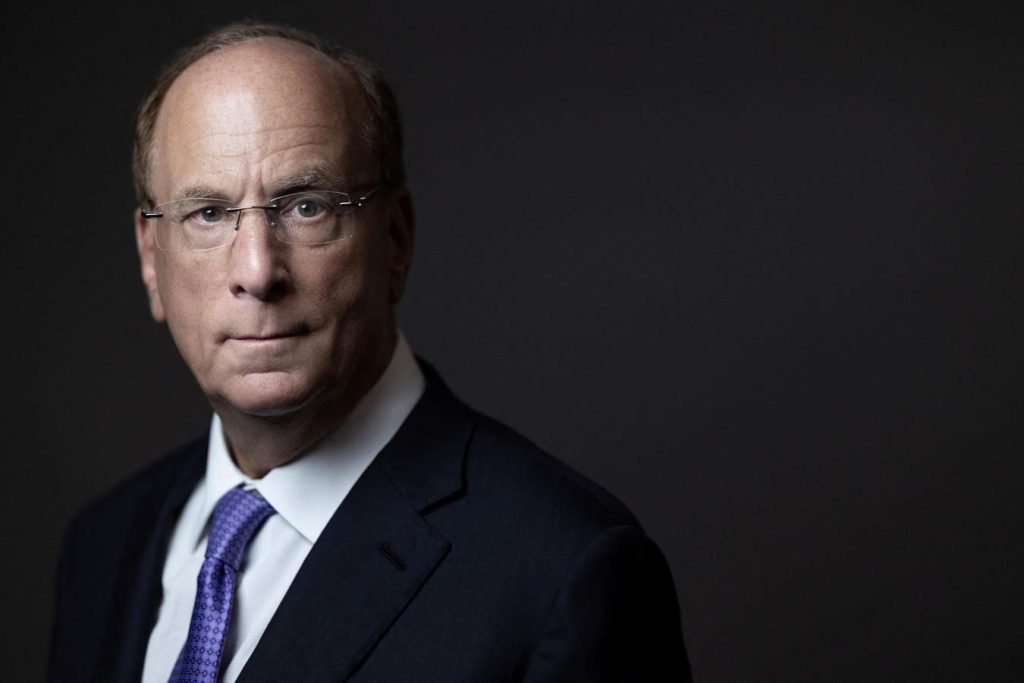

In his annual Chairman’s Letter to Investors, BlackRock CEO Larry Fink revealed a new strategy that focuses on energy pragmatism and moves away from the traditional ESG investment framework. While ESG investing has gained popularity in recent years, Fink’s pivot in strategy comes after facing backlash from conservatives and political pressure. BlackRock, as the world’s largest asset manager with over $10 trillion in assets, has been at the forefront of the ESG movement, but recent events have led to a shift in approach.

In response to criticism and divestments from conservative politicians, Fink has decided to distance himself from the term ESG, opting instead for terms like stakeholder capitalism, sustainable investing, and climate investing. Despite the political backlash, BlackRock saw a 16% increase in managed assets in 2023, reaching $10 trillion. This success was further highlighted at the 2023 United Nations Climate Change Summit, where the United Arab Emirates invested $30 billion in the Alterra climate fund, with $2 billion going to BlackRock.

However, not all news has been positive for BlackRock, as in March 2024, the Texas State Board of Education decided to pull $8.5 billion in investments from the asset manager. This move has been seen as a blow to BlackRock and its ESG initiatives, but Fink remains focused on attracting new investments, as the Alterra fund aims to attract $250 billion by 2030, with BlackRock expected to receive a significant portion. Fink’s new approach to energy pragmatism and focus on energy security may help alleviate concerns raised by critics and appeal to a wider audience.

Fink’s energy pragmatism approach emphasizes the need for a balance between energy transition to renewable sources and energy security, especially in the wake of Russia’s invasion of Ukraine. By highlighting the importance of both renewable energy and traditional hydrocarbons in the energy mix, Fink aims to address the concerns of stakeholders and policymakers. This strategy may also help bridge the divide between opposing views on energy sources and pave the way for a more inclusive and forward-thinking approach.

In his letter, Fink also addresses the energy challenges faced by Texas, emphasizing the state’s need for additional dispatchable power sources to prevent devastating brownouts. He points out that while Texas already relies on 28% renewable energy, additional power from natural gas may be necessary to meet growing demand. By convening a summit of investors and policymakers, BlackRock aims to find solutions to Texas’ energy challenges and support the state’s transition to a more sustainable energy future.

Ultimately, Fink’s pragmatic approach to energy and sustainability investing reflects a shift in strategy for BlackRock, as the company navigates political pressures and stakeholder concerns. By emphasizing the importance of energy security, decarbonization, and client mandates, Fink aims to balance the interests of all stakeholders while driving positive change in the energy sector. As the presidential election approaches, Fink’s approach may serve as a model for bridging the gap between renewable energy advocates and traditional energy supporters, paving the way for a more comprehensive and inclusive energy strategy in the future.