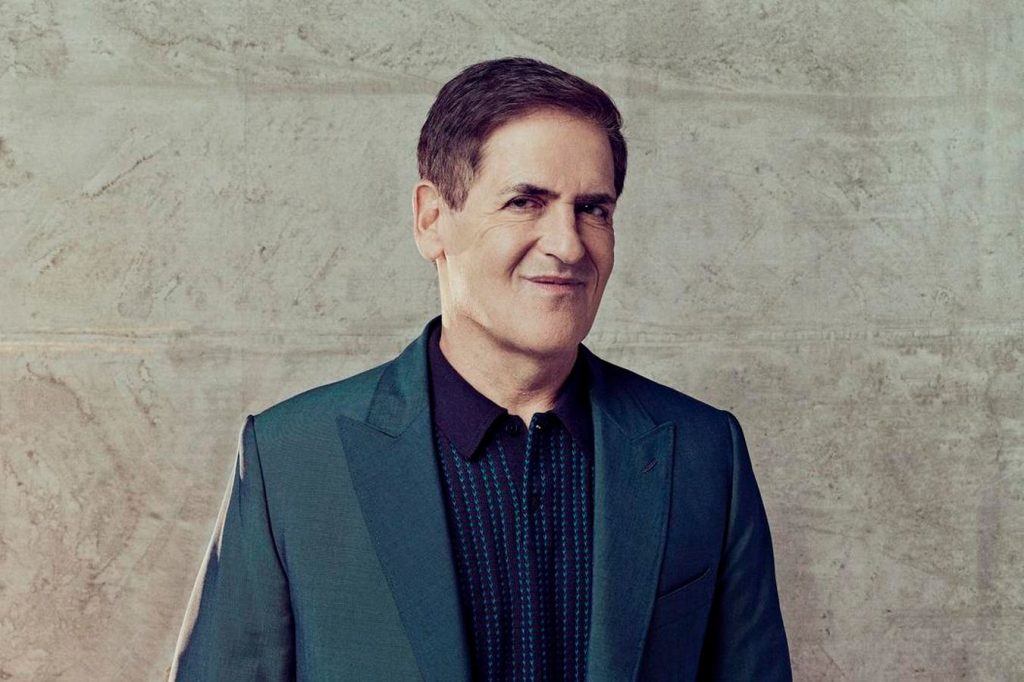

Billionaire entrepreneur Mark Cuban made headlines recently for proudly announcing his massive tax bill of $275.9 million, calling it a patriotic duty to contribute to the country. Known for his fortune and investments, Cuban’s tax bill was unusually high this year due to the sale of a significant portion of his ownership in the Dallas Mavericks basketball team. This sale, valued at $3.5 billion, resulted in Cuban’s estimated pre-tax windfall of $1.75 billion. Typically, Cuban’s fortune consists of his stake in the Mavericks, cash holdings, and investments.

While the $280 million tax bill is staggering, it likely involved deductions and adjustments to reduce the amount owed. Capital gains tax rates for high-income earners are typically around 23.8%, but sports team sales can involve complex calculations, especially for long-held assets like the Mavericks. One potential explanation for the lower tax bill could be that Cuban did not include all proceeds from the sale, as deals like this are often structured in installments. Cuban, who acknowledged using savvy tax strategies like investing in opportunity zones to reduce his tax burden, revealed that he always gets audited by the IRS.

Despite potential financial risks posed by proposed tax laws, such as Senator Elizabeth Warren’s billionaire tax, Cuban remained committed to paying his taxes and giving back to the country. In a recent interview with Forbes, Cuban stressed the importance of being rich not just for personal wealth but for the ability to contribute to society through taxes. He emphasized that paying taxes is a way to support the country and its citizens. Cuban’s open acknowledgment of his tax obligations and his willingness to contribute to the tax system sets him apart from other billionaires who may resist such obligations.

Cuban’s history of paying taxes and his recent substantial contribution come in the midst of ongoing debates about taxing the wealthy and redistributing wealth in the country. As a prominent figure in the business world, Cuban’s actions and statements regarding taxes have drawn attention and sparked discussions about the responsibilities of the ultra-wealthy in supporting the country through taxes. His willingness to openly share details about his taxes and his strategies for reducing them show a transparency and accountability uncommon among billionaires.

While the exact details of Cuban’s tax bill remain private, his openness about the process and his commitment to fulfilling his tax obligations offer insight into his views on taxes and wealth distribution. By showcasing his substantial contributions and acknowledging the benefits of being rich, Cuban stands out as a wealthy individual who values giving back to society through taxes. As debates about taxing the wealthy continue, Cuban’s example of embracing tax responsibilities could influence others in the ultra-rich community to prioritize contributing to the country through taxes.