Ultratech Cement, led by Indian billionaire Kumar Mangalam Birla, has announced plans to acquire a 23% stake in India Cements for approximately $226 million. This strategic move is aimed at solidifying Ultratech’s position in the industry amid India’s growing construction sector. The company plans to purchase 70.6 million shares of India Cements at 267 rupees per share, with the transaction to be completed in cash within one month.

This acquisition will make Birla the second-largest shareholder in India Cements, strengthening the group’s presence in southern India. It will also widen the gap between Ultratech and Ambuja Cement, owned by billionaire Gautam Adani, who recently made headlines for acquiring Penna Cement Industries for $1.2 billion. Adani’s expansion in the cement business aims to increase the group’s annual output to 140 million tonnes by 2028, challenging Ultratech’s current production of nearly 153 million tonnes per year.

The Adani Group’s entry into the cement industry two years ago with the acquisition of Ambuja and ACC has been part of a broader effort to capitalize on Prime Minister Narendra Modi’s infrastructure modernization projects in India. As the government seeks to boost housing supply and upgrade infrastructure, companies like Ultratech and Adani are positioning themselves to benefit from the country’s growth opportunities.

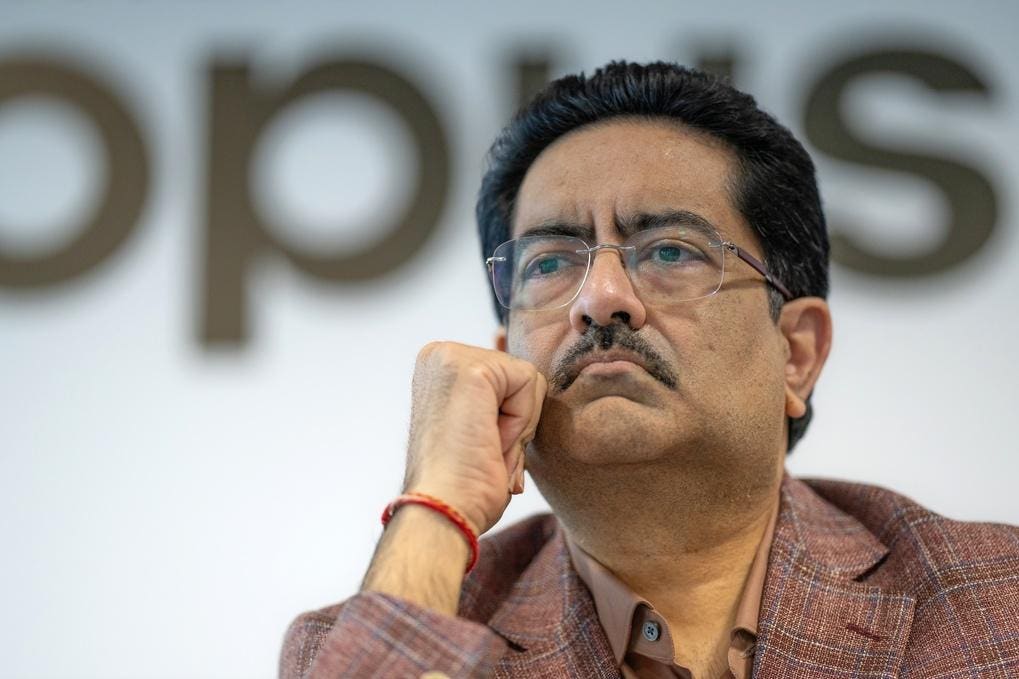

This latest deal further solidifies Ultratech’s commitment to India Cements, following the announcement of plans to acquire the company’s grinding unit for $37 million earlier this year. Kumar Birla, with a net worth of $23.4 billion according to Forbes, is the fourth-generation head of the Aditya Birla Group, which has diverse interests across sectors such as textiles, aluminum, telecom, financial services, and paints. The group has also expanded into new areas like branded jewelry and hospitality as part of its growth strategy.

Overall, the acquisition of a stake in India Cements reflects Ultratech’s ambition to strengthen its position in the cement industry and capitalize on India’s construction boom. With Birla’s leadership and the group’s diversified portfolio, Ultratech is well-positioned to navigate the competitive landscape and take advantage of opportunities in India’s growing infrastructure sector. As the acquisitions and investments continue, the Birla-led group is expected to further solidify its foothold in the market and maintain its industry lead.