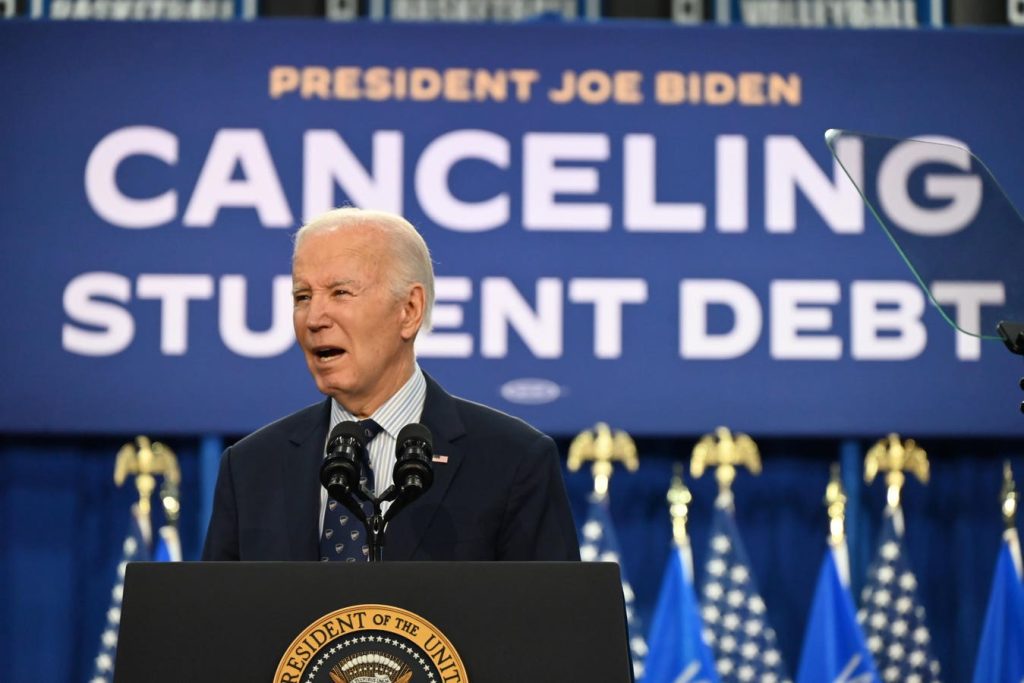

President Joe Biden has introduced a student loan forgiveness plan that aims to provide relief to up to 30 million borrowers. This new initiative focuses on addressing the issue of interest accrual and capitalization, which has caused many borrowers to owe significantly more than they originally borrowed. The plan targets borrowers who have been impacted by these issues and outlines specific eligibility criteria for debt cancellation.

One of the main components of the plan is to forgive student loan interest for all borrowers who have accrued or capitalized interest on their loans since entering repayment. This would provide relief to low and middle-income borrowers enrolled in income-driven repayment plans, with the possibility of canceling their entire interest balance. Borrowers who do not meet these income requirements would still be eligible for up to $20,000 in student loan forgiveness associated with interest capitalization.

In addition to addressing interest-related issues, Biden’s plan also includes four other grounds for loan cancellation, such as being in repayment for more than 20 or 25 years, attending low-financial-value programs, and experiencing financial hardship. While the program is not yet available for borrowers to apply for student loan forgiveness, the Education Department is expected to publish the final regulatory language next month, with a public comment period to follow. The program could potentially be implemented by the fall, although legal challenges may arise.

The root of the problem lies in the fact that unsubsidized federal student loans start accruing interest immediately after disbursement, leading to borrowers owing more than they originally borrowed. Interest can also accumulate during periods of non-payment, including grace periods, forbearances, and deferment periods. Borrowers who have been repaying their loans under income-driven repayment plans may also experience significant balance growth due to interest accrual and capitalization, potentially resulting in higher taxes if forgiveness is received.

Overall, Biden’s new student loan forgiveness plan is designed to provide much-needed relief to borrowers who have been impacted by runaway interest and other student loan issues. By canceling interest for eligible borrowers and providing additional grounds for loan cancellation, the plan offers a path towards a more manageable student loan repayment process. While the program is not yet available, borrowers can expect further details in the coming months, with the potential for implementation by the fall.