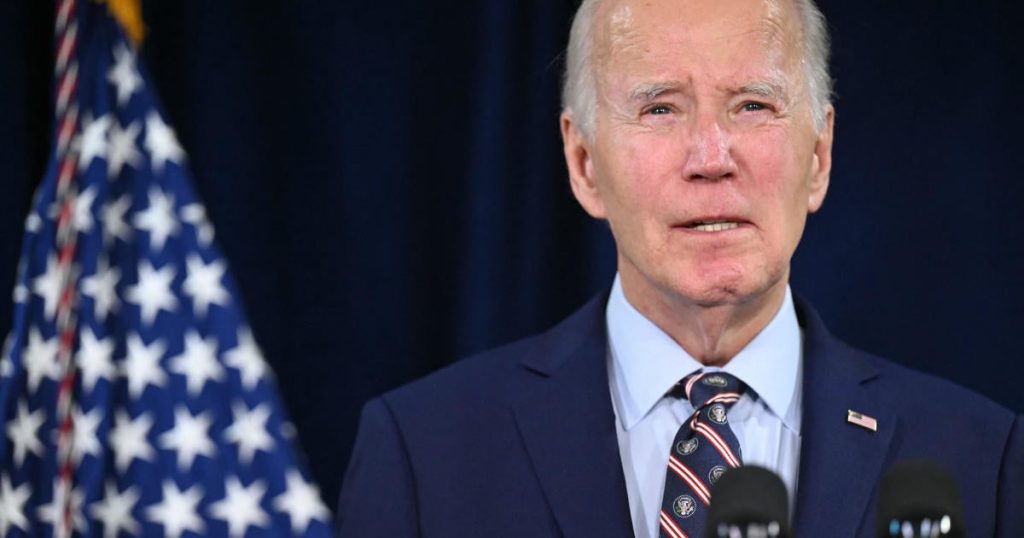

President Biden is expected to make a decision soon about whether he will approve Nippon Steel’s $14.9 billion acquisition of U.S. Steel. Biden has previously expressed opposition to the deal, citing the importance of U.S. Steel remaining American-owned and operated. His top advisers, including Secretary of State Antony Blinken, have been involved in discussions about the acquisition. U.S. Steel has indicated it may file lawsuits if the president blocks the deal, potentially naming Cleveland-Cliffs and its president, as well as U.S. Steelworkers president Dave McCall.

Nippon Steel, headquartered in Japan, recently proposed giving the U.S. government direct veto authority over any changes to U.S. Steel’s production capacity. This was in response to concerns from the Committee on Foreign Investment in the United States (CFIUS) that the acquisition could lead to a decline in domestic steel output and a reduction in the U.S. workforce. An earlier proposal for an independent majority-American board to make production decisions was submitted for Biden’s review. The new proposal would give the U.S. government full decision-making power over changes to production capacity for a 10-year period.

The proposed acquisition by Nippon Steel faced a previous deadline of January 7, which was extended to the first quarter of 2025. Trade Representative Katherine Tai, a member of CFIUS, expressed concerns about the deal’s impact on labor and was opposed to it. However, other agencies on CFIUS, such as the Justice, Treasury, and State Departments, did not oppose the acquisition. The final decision on the deal ultimately lies with President Biden, who will need to weigh the various concerns and proposals put forth by the involved parties.

The potential approval of Nippon Steel’s acquisition of U.S. Steel raises questions around the issue of foreign ownership of critical U.S. companies, particularly in industries like steel production. The proposal for direct vetting authority by the U.S. government over production changes highlights the sensitivity of the matter and the efforts to address concerns about job losses and production capacity reduction. The involvement of various government agencies in the CFIUS review process demonstrates the complexity and importance of such decisions for national security and economic considerations.

The outcome of President Biden’s decision on the Nippon Steel acquisition will have implications not only for the steel industry but also for broader discussions on foreign investment in the U.S. and the protection of American companies from foreign takeovers. The legal challenges mentioned by U.S. Steel and potential repercussions from Cleveland-Cliffs further underscore the contentious nature of the deal and the significance of Biden’s ruling. The proposed 10-year guarantee on production capacity maintenance shows an attempt by Nippon Steel to address concerns and secure approval for its acquisition. The resolution of this issue will likely have lasting effects on the U.S. steel market and the relationship between domestic and foreign steel companies.