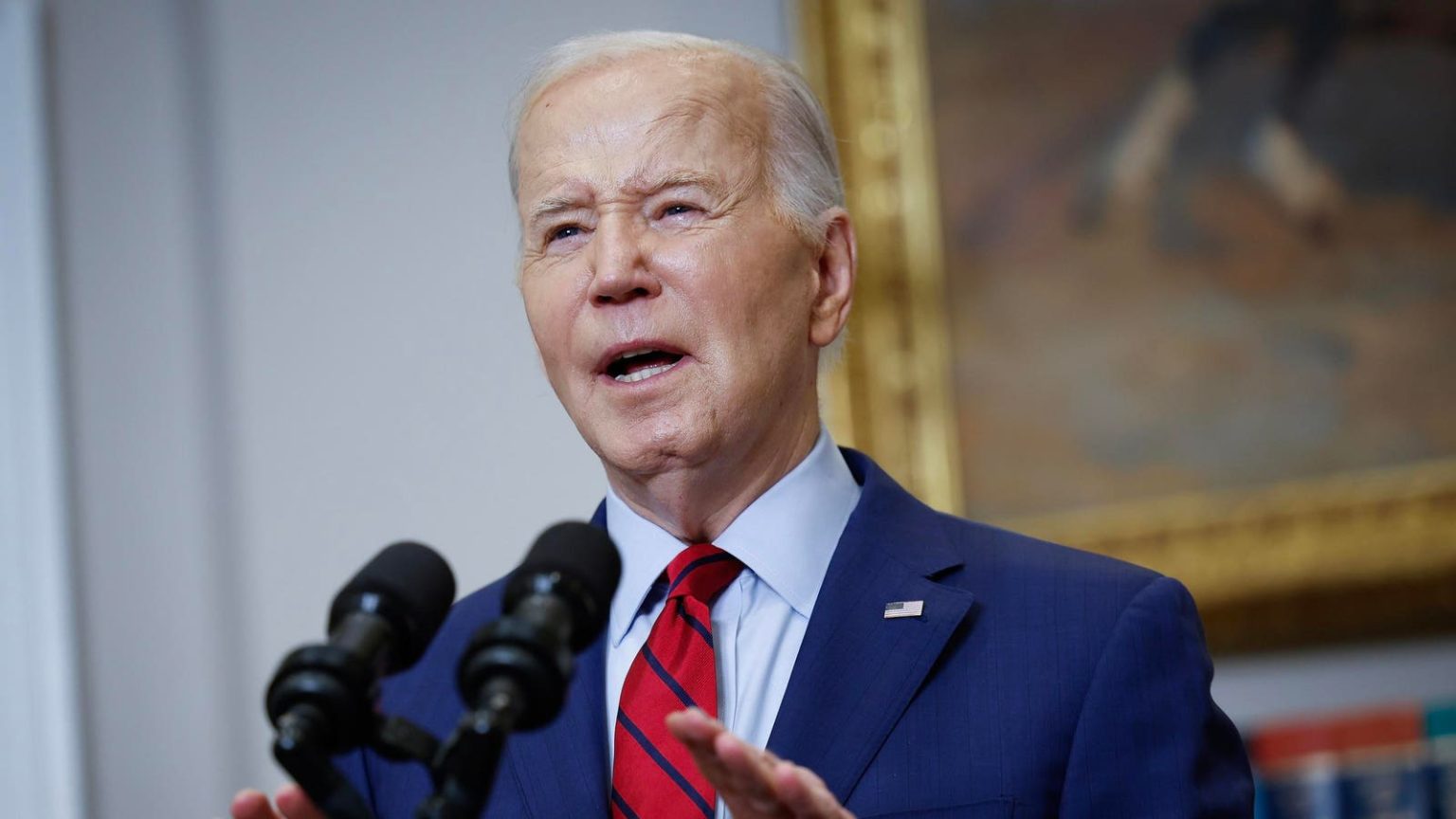

President Joe Biden announced a new round of student loan forgiveness, totaling over $160 billion in relief over the past three years. This recent relief targets borrowers who attended schools accused of misconduct, part of the administration’s approach to holding bad actors accountable and providing needed relief. Biden has indicated that more loan forgiveness initiatives are in the works, including a new mass cancellation program set to launch soon.

In response to last year’s Supreme Court decision striking down Biden’s mass student loan forgiveness plan, the administration has employed various tools to enact significant relief. By updating existing loan forgiveness programs, such as the IDR Account Adjustment and the Public Service Loan Forgiveness program, the Education Department has managed to cancel student loan debt for millions of borrowers. These efforts have resulted in billions of dollars in loan forgiveness for borrowers, with improvements to income-driven repayment plans and other initiatives.

Additionally, the Biden administration has approved over $28 billion in loan forgiveness for borrowers who were harmed by their schools’ misconduct. This includes relief for students of institutions like the Art Institutes, which were found to have misled students about career prospects and job placement services. More than 300,000 former Art Institute students will receive automatic group discharges as part of this latest round of relief.

The Biden administration is finalizing plans for a new student loan forgiveness program, targeting relief for specific groups such as those with significant interest accrual, those who entered repayment over 20 years ago, and students who attended low-value schools. The Education Department released formal regulations governing this program last month, with plans to launch in the fall. Additionally, a hardship-based loan forgiveness option is being considered, taking into account various factors like age, disability, and financial circumstances.

Critics of Biden’s piecemeal approach to student loan forgiveness have called for more extensive relief measures, with some advocating for student loan debt to be classified as a hardship warranting blanket forgiveness. However, officials believe a targeted approach is more likely to withstand legal challenges, particularly given the Supreme Court’s stance on loan forgiveness initiatives. The Education Department is proceeding cautiously with the upcoming debt relief programs, taking into account various factors in determining eligibility for loan forgiveness based on hardship.

Overall, the Biden administration’s efforts to provide student loan forgiveness have resulted in significant relief for borrowers, totaling billions of dollars in debt cancellation over the past few years. With additional initiatives in the works, including a new mass cancellation program and hardship-based relief options, the administration continues to address the student debt crisis faced by millions of Americans. While challenges and legal hurdles remain, the administration remains committed to providing much-needed relief to student loan borrowers.