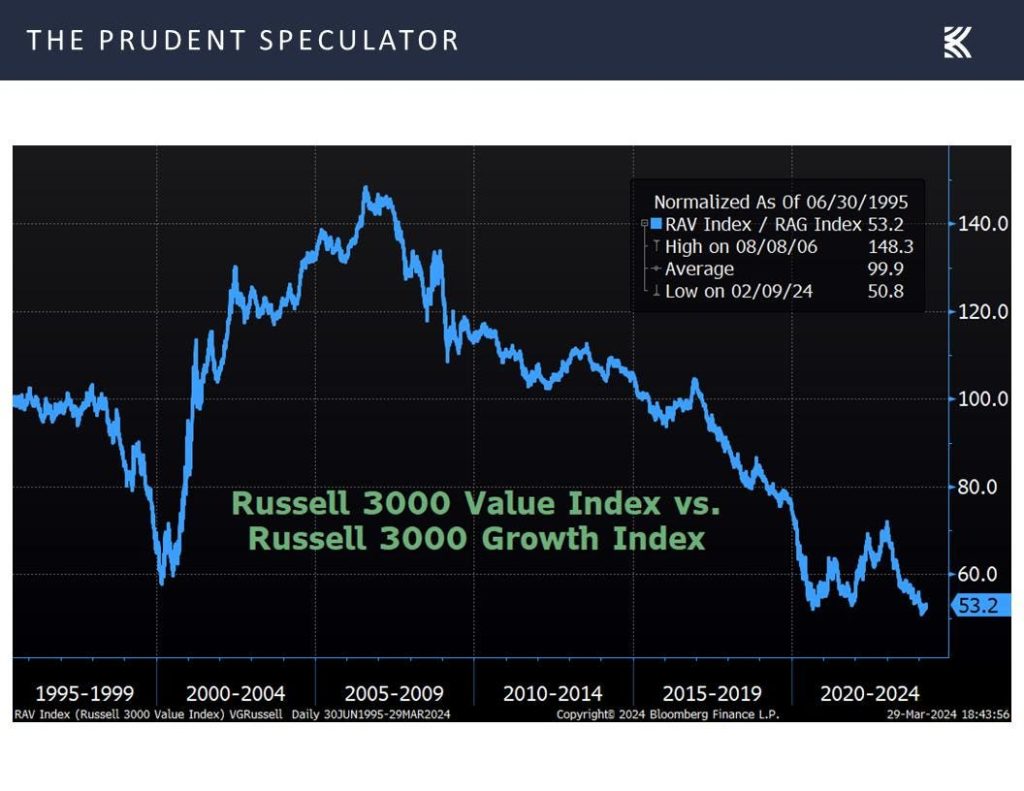

The final few days of March proved to be a positive trading week, with the median stock in the Russell 3000 index gaining 2.2%. The Russell 3000 Value index outperformed the Russell 3000 Growth index by a wide margin, indicative of Value stocks having a moment in the sun due to their attractively priced nature compared to Growth stocks. This trend was reminiscent of the Tech Bubble bursting 24 years ago, signaling a shift in market dynamics.

Economic data for the week was a mix of positive and negative indicators. The Conference Board’s Consumer Confidence measure slightly decreased in March, below projections, while the Univ. of Michigan’s Consumer Sentiment gauge showed improvement over the previous month. Q4 real GDP growth was revised upward to 3.4%, but the big economic news came on Friday with the Core Personal Consumption Expenditure showing a 2.8% year-over-year increase for February. Despite some data falling short of expectations, the overall picture indicated that the economy is not heading for a hard landing.

Looking at the first quarter’s market performance, The Prudent Speculator highlighted the winners and losers for its equity-focused newsletter. Historically, the newsletter’s winners have outweighed the losers, suggesting a positive outlook for investors. With this in mind, readers were encouraged to focus on the winners when considering potential stock purchases. The article serves as a valuable resource for recent stock market news, investing tips, and economic trends, offering insights for readers seeking to navigate the complexities of stock trading.

The full-length article was published on theprudentspeculator.com, offering in-depth analysis and commentary on recent market movements. Readers were encouraged to sign up for regular reports like this one, along with free stock picks, to stay informed about market trends and investment opportunities. The Prudent Speculator’s weekly commentary provides valuable insights for investors looking to make informed decisions in a dynamic market environment. By staying up to date with the latest news and trends, readers can position themselves for success in their investment endeavors.