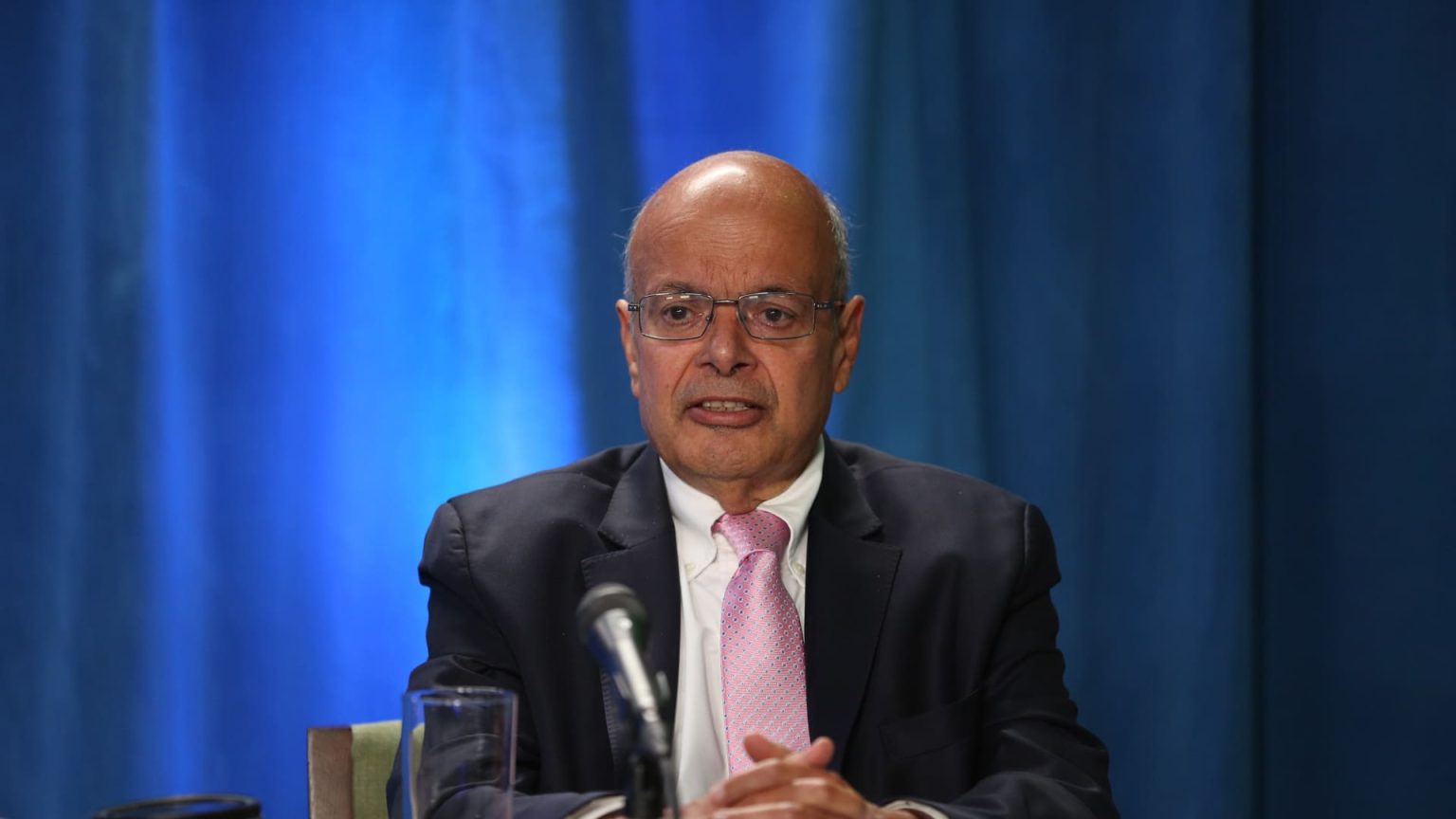

Ajit Jain, Warren Buffett’s insurance chief and top executive, recently sold more than half of his stake in Berkshire Hathaway, according to a regulatory filing. The 73-year-old vice chairman of insurance operations sold 200 shares of Berkshire Class A shares at an average price of $695,418 per share, totaling roughly $139 million. This move left him holding just 61 shares, while family trusts and a non-profit corporation he established hold additional shares. The sale represented 55% of Jain’s total stake in Berkshire, marking the biggest decline in his holdings since he joined the company in 1986.

The reasons behind Jain’s decision to sell remain unclear, but he may have taken advantage of Berkshire’s recent high stock price, which allowed the company to reach a $1 trillion market capitalization at the end of August. This move is consistent with a slowdown in Berkshire’s share buyback activity as of late, with the company repurchasing significantly less stock in the second quarter compared to previous quarters. Some analysts view Jain’s sale as an indication that Berkshire’s stock may be fully valued, with the price possibly being close to Buffett’s conservative estimate of intrinsic value.

Ajit Jain has been instrumental in Berkshire’s success, playing a key role in the company’s push into the reinsurance industry and leading a turnaround in Geico, Berkshire’s auto insurance business. In 2018, he was named vice chairman of insurance operations and appointed to Berkshire’s board of directors. Warren Buffett himself has praised Jain’s contributions, stating in his annual letter in 2017 that Jain has created “tens of billions of value” for Berkshire shareholders and expressing willingness to swap himself for Jain if another executive like him were to emerge.

While there were rumors about Jain potentially leading Berkshire in the future, it was announced that Greg Abel, Berkshire’s vice chairman of non-insurance operations, would eventually succeed Buffett. Buffett has clarified that Jain never expressed a desire to run Berkshire, and there was no competition between the two executives. Jain’s decision to sell a significant portion of his Berkshire stake may signal his belief that the stock is fully valued at its current price, which is reflected in the reduced share buyback activity by the company.

Overall, Ajit Jain’s sale of more than half of his stake in Berkshire Hathaway has raised questions about the valuation of the company’s stock and the future leadership of the conglomerate. While Jain has made significant contributions to Berkshire’s success, it remains to be seen how his decision to reduce his stake will impact the company’s performance and strategic direction moving forward. Buffett’s acknowledgment of Jain’s value to Berkshire shareholders and his decision to appoint Abel as his successor indicate a well-thought-out transition plan within the company’s leadership structure.