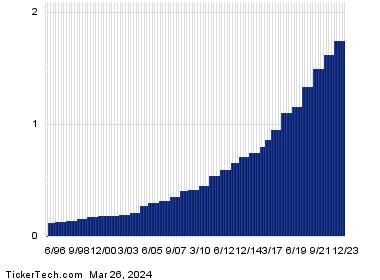

Air Products & Chemicals will trade ex-dividend on 3/28/24, with a quarterly dividend of $1.77 payable on 5/13/24. This represents approximately 0.75% of APD’s recent stock price of $237.56. Share prices are expected to trade 0.75% lower when the market opens on 3/28/24. The dividend history chart for APD shows the previous dividends paid by the company.

Dividends are not always predictable, but historical data can help determine if the current dividend is likely to continue. The current estimated yield of 2.98% on an annual basis can provide insight into the expected annual yield going forward. The chart also shows the one-year performance of APD shares compared to its 200-day moving average.

The 52-week range for APD shares is $212.24 to $307.71, with the last trade at $238.60. This information can give investors an idea of the stock’s performance over the past year. In Tuesday trading, Air Products & Chemicals Inc shares were up about 0.4% on the day.

Investors should consider the upcoming ex-dividend date and dividend payment when making investment decisions. The dividend history and performance of APD shares can provide valuable information for investors. Monitoring the stock’s movement in relation to its 52-week range can also help investors make informed decisions.

Overall, the dividend payout and performance of Air Products & Chemicals Inc can impact investors’ decisions on buying or selling shares. The company’s upcoming dividend payment and historical data can provide valuable insights for investors. APD’s stock performance in Tuesday trading indicates the market’s reaction to the company’s dividend announcement.