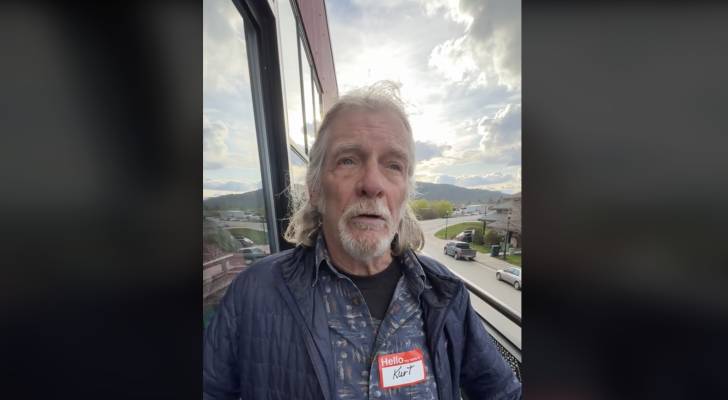

A viral video of a Montana man, 68, pleading for a moratorium on property taxes has shed light on the challenges faced by homeowners in the Treasure State. The man, identified as Kurt, reveals that his annual property taxes have increased by almost 790% in recent years, reaching a staggering $8,000. This drastic hike in taxes has forced him to continue working in his retirement years just to cover the mounting costs, which he likens to paying $700 a month in rent to the state. Kurt’s plea for relief underscores the struggles faced by many Montana homeowners who are grappling with exorbitant property tax bills.

The surge in property taxes experienced by Kurt and other homeowners in Montana can be attributed to several factors, including the increase in property values over time. Property taxes are typically based on a percentage of a home’s assessed value, so as property values rise, so do tax bills. In Kurt’s case, the value of his family home has likely appreciated significantly since he purchased it in 1995. The rapid increase in property values in Montana, fueled by a surge in demand and limited housing supply, has contributed to the spike in property taxes that many residents are currently facing.

Despite the option to sell his family home and downsize to a more affordable property, Kurt is determined to hold onto the house due to its sentimental value. However, for other homeowners in Montana facing similar challenges, selling their homes and moving to a more manageable location may be the only viable solution. A recent analysis by the Montana Free Press found that the median residential property owner in Montana saw a 21% increase in their property taxes this year, with typical hikes ranging from 11% to 35%. For many homeowners, the rising tax burden has become unsustainable, prompting calls for relief from the state government.

Property taxes play a crucial role in funding local government services in Montana, accounting for almost 97% of local tax revenue in the state. The heavy reliance on property taxes is likely due to the absence of state or local sales tax in Montana, which results in comparatively lower tax revenue from other sources. The revenue generated from property taxes primarily goes towards supporting essential services such as K-12 schools, law enforcement, and fire departments at the county and city level. As inflation and the costs of public services continue to rise, some local governments have had to increase property tax rates to offset these expenses.

While the Montana Department of Revenue has introduced property tax rebates for eligible homeowners in 2022 and 2023, the prospect of a moratorium on property taxes remains unlikely. The rebates, totaling up to $675 per homeowner, are funded by a portion of the state’s budget surplus. However, the long-term solution to alleviating the burden of property taxes on Montana residents remains uncertain. The ongoing challenges faced by homeowners like Kurt highlight the need for sustainable solutions to address the increasingly unaffordable cost of property ownership in the state. As Montana grapples with rising property values and tax bills, residents are left searching for ways to maintain their homes and financial stability in the face of mounting economic pressure.