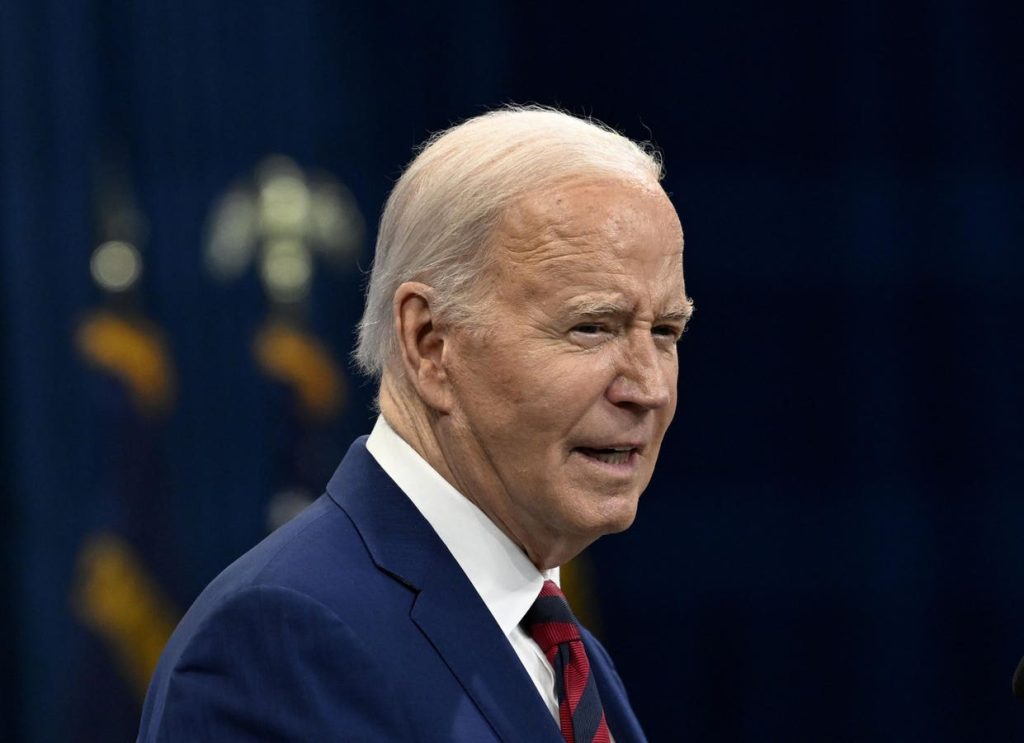

Last week, Republican state leaders from nearly a dozen states filed a lawsuit against the Biden administration, seeking to block the SAVE plan, a new income-driven repayment option aimed at providing affordable payments and eventual loan forgiveness. President Joe Biden has touted SAVE as the most generous Income-Driven Repayment plan in history. The lawsuit argues that the SAVE plan is an overreach by the Biden administration to enact mass student loan forgiveness contrary to Congressional intent, while the administration maintains that there is clear legal authority for the program.

Impacts of the legal challenge on student loan forgiveness could vary depending on the court’s ruling. If a judge rejects the challenge, borrowers already enrolled in SAVE and those applying to switch plans may not be impacted. However, if the challengers prevail, the impacts on student loan forgiveness are unclear. Last month, the Biden administration approved over 150,000 borrowers for student loan forgiveness under the early debt cancellation feature of SAVE, but it is unknown if a court could reverse those approvals and reinstate balances, as well as whether the Education Department could handle such a mass reversal.

Potential impacts to student loan payments could affect approximately 7.5 million borrowers enrolled in SAVE if the court issues an adverse ruling. A federal student loan repayment plan has never been blocked by a court before, so the outcomes would be unprecedented and uncertain. Borrowers already enrolled in SAVE could be grandfathered in if the program is blocked for new applicants, while others may be bumped back into an older, more expensive IDR Plan, resulting in increased monthly payments.

While the latest legal challenge targets the regulations governing the SAVE plan, other student loan forgiveness programs like Public Service Loan Forgiveness, Total and Permanent Disability Discharge, and student loan forgiveness under Income-Based Repayment are not at risk from this suit. The IDR Account Adjustment, a separate Biden administration initiative aimed at fixing student loan forgiveness under all income-driven repayment plans, is also not part of this challenge. Nearly a million borrowers have already benefitted from this initiative.

Despite the legal challenges, the Biden administration is continuing to push ahead with new student loan forgiveness initiatives. In addition to SAVE, the IDR Account Adjustment, and fixes to Public Service Loan Forgiveness and other debt relief programs, a new loan forgiveness plan is being developed for several categories of borrowers. The Education Department completed the rulemaking process earlier this year, and the final regulations are expected to come out in May, with the program possibly going live as soon as this summer or fall. However, with expectations of more legal challenges ahead, the future of these initiatives remains uncertain.