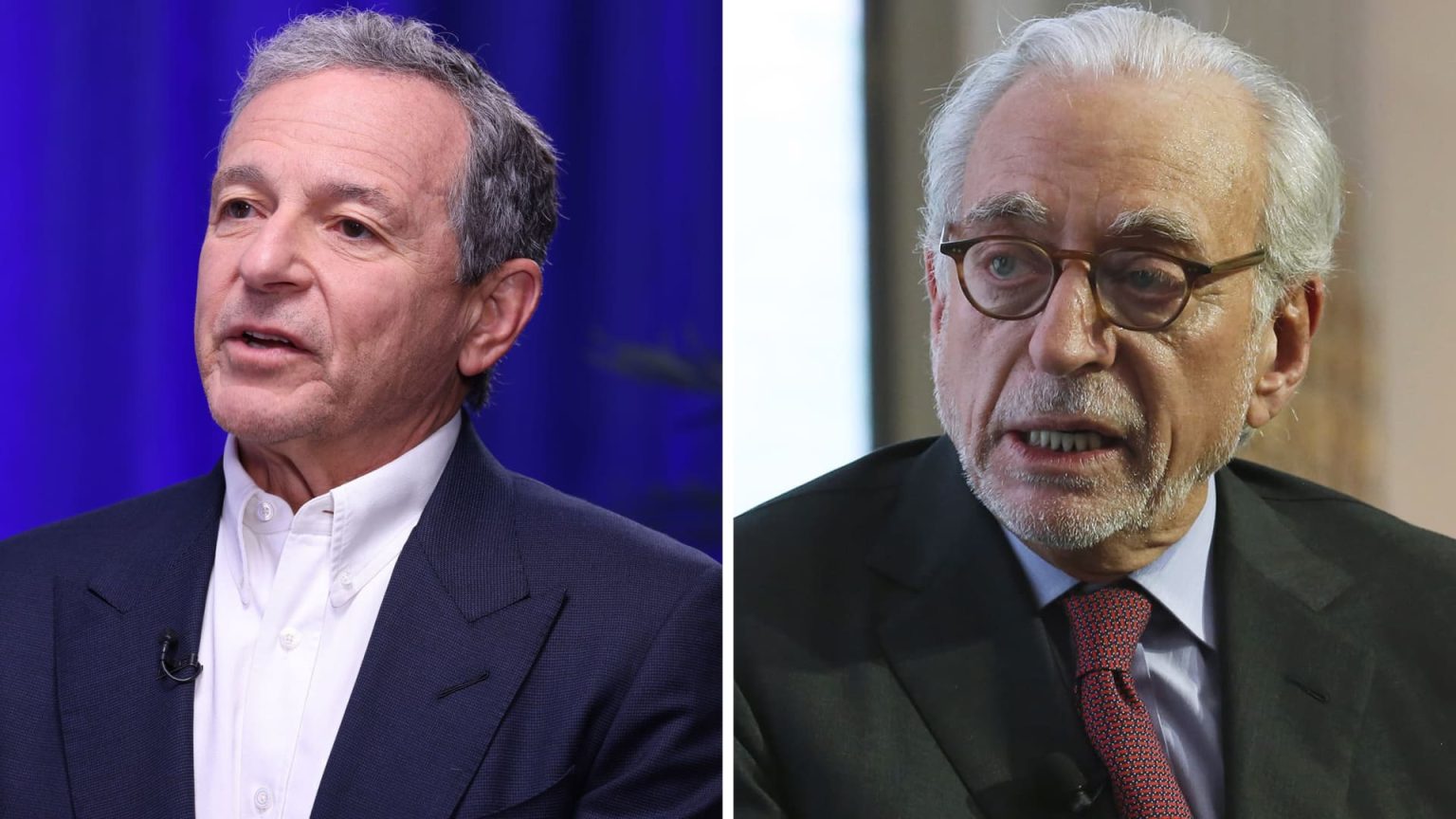

The second quarter begins with a rough start for markets, as bond yields are rising and the Federal Reserve is expected to not cut interest rates in June. The Dow dropped nearly 400 points, the S&P 500 fell 0.7%, and the Nasdaq Composite tumbled nearly 1%. Investors will be closely watching the ADP private payrolls report and March jobs data this week. Activist investor Nelson Peltz’s battle against Disney comes to a head as shareholders vote on Wednesday on whether the current board should remain or be replaced by candidates nominated by Peltz, who has criticized the company’s lack of significant returns and succession planning.

Tesla saw its first year-over-year decline in deliveries since 2020, reporting 386,810 vehicle deliveries in the first quarter, an 8.5% drop from a year ago. Analysts were expecting deliveries of about 457,000 for the period. The company faced challenges in the first quarter, including disruptions at a German factory. Shares of major U.S. health insurers fell sharply after the Biden administration’s announcement of payments for private Medicare plans that disappointed the industry and investors, putting more pressure on the companies as they deal with high medical costs. Humana’s stock sank 13%, while CVS Health and UnitedHealth Group also saw declines.

Oil prices reached their highest level since October on Tuesday, driven by heightened geopolitical risk and robust economic data. U.S. crude oil gained $1.44 to settle at $85.15 a barrel, while the Brent contract added $1.53 to $88.94 a barrel. Investors are closely monitoring conflicts in the Middle East that could threaten oil supply, as well as a Ukrainian drone strike on a major Russian oil refinery. Overall, the market is facing uncertainty as the second quarter begins, with investors closely watching economic data and geopolitical developments that could impact various sectors.

The rough start in the markets at the beginning of the second quarter is driven by rising bond yields and lower expectations of a June interest rate cut by the Federal Reserve. The Dow, S&P 500, and Nasdaq Composite all experienced losses, with investors keeping a close eye on upcoming jobs data. The battle between activist investor Nelson Peltz and Disney reaches a climax as shareholders vote on whether to keep the current board or replace certain directors with candidates nominated by Peltz, who has criticized the company’s performance and succession planning.

Tesla experienced its first year-over-year decline in deliveries since 2020, reporting lower-than-expected numbers for the first quarter due to various challenges, including disruptions at a German factory. Major U.S. health insurers saw their stock prices fall sharply after the Biden administration announced payments for private Medicare plans that disappointed the industry and investors. The decision puts more pressure on the companies as they navigate high medical costs. Oil prices surged to their highest levels since October, driven by geopolitical risk and economic data, with investors closely monitoring conflicts that could impact oil supply. The market is facing uncertainties in the second quarter, with various factors impacting different sectors and creating volatility for investors.